What is Securitization?

Securitization is the financing of a pool of assets through the issuance of securities. These transactions gained particular traction in the 1970s, starting with the financing of mortgage pools. Over time, securitization has evolved to include different kinds of assets. These can be as varied as receivables, private debt or shares, commodities, or real assets like art, infrastructure projects or real estate. Today, securitization transactions have become an integral part of the global financial system, particularly in the European and American capital markets.

Securitization SPVs

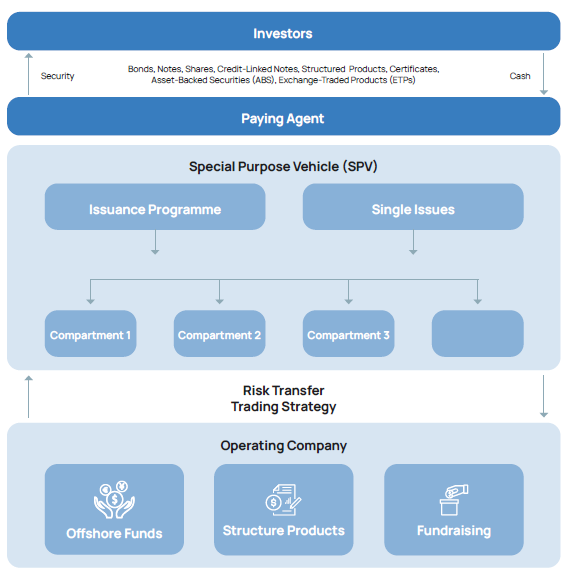

Financial products through securitizations are independent, off-balance sheet, multi-issuance programs that offer a cost effective, transparent and bespoke investment vehicle for both actively managed certificates and global note programs (asset backed securities). Soter Capital Advisors creates financial products with an ISIN code which makes it Euroclearable and bankable, freely transferrable and can be placed with a broad range of investors. Upon request our products may be listed on the stock exchange.Flexibility in choosing the jurisdiction: Luxembourg, Lichtenstein, Ireland, Guernsey. Pre-packaged services allow a speedy and efficient solution. Within less than two weeks the vehicle can be set-up and the corresponding product issued.

As a result, they meet the requirements of investors as well as being easier to distribute than other alternative investment structures subject to regulatory regimes such as AIFMD.